I Hope This Helps 👍🏽: Taxes 💸 & Tower of Power 🎷

Tax fraud is what sent Al Capone to jail. Let's turn our attention to this powerful act of authority in this edition of I Hope This Helps👍🏽!

“In this world nothing can be said to be certain, except death and taxes”

~Benjamin Franklin

Welcome to I Hope This Helps, a weekly (ish) roundup of tidbits I’ve encountered that furthered my thinking about cities and life. From sustainable transportation to housing, to design, and the social forces shaping our daily lives, I take a broad lens in this review. In this week’s edition, taxes.

The Tax Foundation, a global nonprofit focused on tax polity, defines taxes as follows:

Tax (n) - A tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

If we want a government that provides essential services, then taxes are a necessary prerequisite. However, when taxes are used to mask bad financial governance, the trust between the government and the people it’s governing (see taxing) becomes strained. An fatal inversion occurred. Taxes, ostensibly levied to support the lives of the people being governed, are now being imposed upon the people in support of the government itself. To quote another global historical figure:

“I contend that for a nation to try to tax itself into prosperity is like a man standing in a bucket and trying to lift himself up by the handle.”

~Winston S. Churchill

Taxes do not create value. They capture and redirect value that was already being created. According to the Tax Foundation, sound tax policy must be simple, transparent, neutral, and stable. With this in mind, let’s take a dive into how we employ taxes in cities and see how it aligns with the Tax Foundation’s guidance.

Preface. I’m just a transit planner. I have a B.S. in Industrial Management and an M.A in Urban Sustainability. My authority on this subject is shaky at best. That being said, I’m married to a CPA, I read The Economist, and I pay taxes, so with that authority (and healthy dose of ✨gay audacity💅🏽1), here we go.

Whether you're a planner, advocate, or just curious about the world around you, I hope you’ll find something here that resonates. Take what helps. Leave what does not.

1️⃣Every Type of Tax Explained

Check out this Youtube video for a crash course on the main types of taxes that exist, and how they work. It lays a solid foundation for the rest of this edition (start at 0:45 if you want to keep this party prosaic).

2️⃣ The Laffer Curve

The Laffler Curve suggests that there is an ideal tax rate, and any taxes above this point generate less tax revenue because they incentivize people to do business elsewhere, underground, or not at all.

From Investopedia:

The Laffer curve is a curve depicting the relationship between tax rates and revenue, based on a theory by economist Arthur Laffer.

Created in 1974, the curve visually represents total tax revenue collected by governments as varying depending on the tax rate. The curve is often used to illustrate the argument that cutting tax rates can result in increased total tax revenue.

Key Takeaways

American economist Arthur Laffer developed a bell-curve analysis in 1974 known as the Laffer curve.

The Laffer curve shows the relationship between tax rates and total tax revenue.

The Laffer curve states that total tax revenue is most likely not maximized when tax rates are at 100% because this disincentivizes workers from earning wages.

The Laffer curve was used as a basis for tax cuts in the 1980s during the Reagan Administration.

Critics argue that the Laffer curve is too simplistic and that it uses a single tax rate.

If you don’t think taxes influence behavior, ask:

a person living near the Illinois/Indiana border where they buy their gas from?

a person on the Minnesota/Wisconsin border where they buy their clothes from?

a person on the Illinois/Missouri border where they buy their liquor from?

a person on the Missouri/Kansas border where they buy their liquor from?

a stoner in the Great Lakes region where they buy their 🍃from?

3️⃣About Here Tax Video

We need to build more housing, and all of our policy levers (taxes included) should point in that direction. This video looks into a specific tax relevant to urban governance; development fees2.

Development fees (n) - one-time payments assigned to new developments to pay for the added infrastructure required to support the development.

Makes decent sense for sprawling development patterns (if there’s not a road there yet, somebody’s got to pay for it3). Makes less sense for infill development.

Infill development (n) - Refers to the construction of buildings or other facilities on previously unused or underutilized land located within an existing urban–or otherwise developed–area. This type of development is meant to encourage density and accommodate environmentally sustainable urban growth by making use of existing utility and transportation infrastructure.

Beyond being great for walkability, bike-ability and transit usefulness, infill development is great for municipal budgets. It increases the tax base without significantly increasing the infrastructure required to support it.

Development fees often undermine infill development. However, since development fees are calculated formulaically using a combination of assumption based projections and modeling outputs, they’re great for patching holes in local government budgets.

Note: Check out small housing (mentioned in the video) to learn about “Gentle Density”

4️⃣Grocery Taxes in Illinois

In August of 2024, Governor J.B. Pritzker signed HB3144, ending the 1% statewide tax levied on groceries. From an equity standpoint, this is an easy layup. Taxes typically sit along a spectrum from progressive to regressive. Progressive taxes impact higher income earners more than lower income earners. Regressive taxes impact lower income earners more than higher income earners. Grocery taxes are a textbook regressive tax. Everybody has to buy food, but a household making $40k a year is more sensitive to the price of food than one making $140k a year. Of the 5 states that border Illinois, only Missouri taxes groceries. Nationwide, 36 states, including California, New York, Texas, and Florida do not tax groceries.

Despite the regressive nature of grocery taxes, dozens of Illinois municipalities have moved to reinstate this tax within their boundaries in advance of the 2026 deadline imposed by HB3144 (Illinois Policy Institute4).

Chicago is one of the cities looking at reimposing the tax. When Mayor Brandon Johnson5 was asked about this he responded:

“The city of Chicago will not enact its own grocery tax. The grocery tax already exists. There is a process in which the collection of the grocery tax is now being placed in the responsibility of municipalities,” Johnson said at a press briefing. “We’re not creating a grocery tax. We’re just creating a process by which we can collect it.”

More telling were comments from Annette Guzman, Chicago’s budget director:

“We must reaffirm the grocery tax before the state’s deadline of Oct. 1. Allowing that tax to lapse in January 2026 would cost the corporate fund an estimated $80 million next year alone, further exacerbating our $1 billion-plus gap,” Guzman said. “Nearly 200 other municipalities in Illinois, from Berwyn to Wheaton and beyond, have already voted to extend this grocery tax. … If we fail to do the same, we will leave critical services on the chopping block.”

Remember that inversion I mentioned earlier?

5️⃣2025 Chicago Budget

Let’s keep inversions in mind when we discuss this next topic; the City of Chicago’s approved 2025 budget and how we got there. In the fall of 2024, the city began the budgeting process looking down a $982 million budget shortfall. Since 2020, City of Chicago spending has increased nearly 50%. This includes 41 new hires at the City’s Department of Human resources6, 79 new tree trimmers7 and a slew of salary increases. When asked about his openness to reducing spending to close this deficit, Mayor Brandon Johnson had the following to say:

"What would I like to cut? Nothing, I mean, why would I cut anything?"

Insistent on not cutting any spending, the mayor’s first budget proposal included a proposed $300 million property tax increase that was unanimously rejected by the city council8. The second proposal reduced the increase to $68.5 million, but it too was rejected. On December 16th, 2024 the Chicago City council narrowly (27-23) approved a $17.1 billion dollar budget that closed this gap not through notable spending decreases or additional property taxes, but with a potpourri of new or increased taxes, including:

an increased tax on streaming services

an increased tax on parking and valet services

an increase to the grocery bag tax

Remember that Winston Churchill quote from earlier?

6️⃣Property Taxes vs Land Value Taxes

Property Tax (n) - A tax on real estate or tangible personal property paid by the property owner.

Property taxes are a key source of revenue for most cities in the United States. This creates perverse incentives, many of which are solved by Land Value Taxes.

Land Value Tax (n) - A tax on the assessed value of the land a property sits on

Check out Chuck Marohn9 of Strong Towns10 talking about Land Value Taxes.

💭From Me

Taxes are a necessary act of authority to run a society. That’s why it’s an indefensible breach of authority to be reckless with tax policy. Don’t trifle with people’s hard earned money. Tower of Power, a 1968 funk band based in Oakland says it best in their song “Taxed to the Max.” Check out a lyrical excerpt from the song:

Politicians promise all they can

To get elected, to make a better land

In a smoke filled room, they're makin' all their plans

But when the smoke gets clear, you know it's just a scam

I'm just an average ordinary kind of guy

Punchin' in at nine, punchin' out at five

Doing all I can to pay the bills on time

No matter how hard I try, I just can't get by

Taxed to the max, but we can't get the facts

They just tell us what they think we ought to know

(We get) taxed to the max, but we don't get it back

Someone tell me where the money really goes

Weapon systems, national defense

Vested interests, it doesn't make no sense

What we think we get, ain't always what we get

They keep raising all our taxes, but we get deeper, deeper in debt

🦄A Moment for Whimsy

Whimsy (n). - capricious humor or disposition; extravagant, fanciful, or excessively playful expression

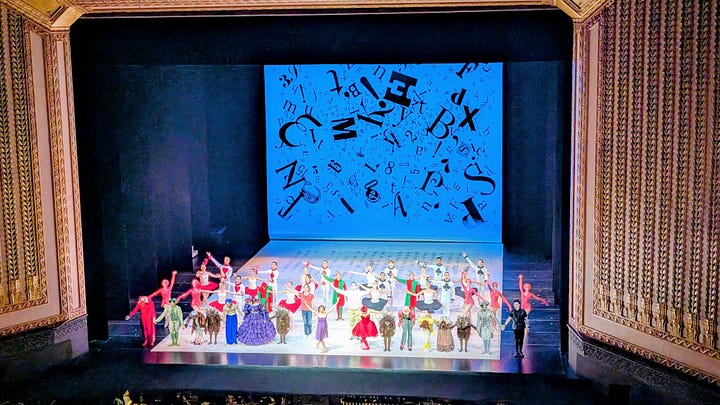

In this week’s moment for whimsy, the Joffrey Ballet’s production of Alice’s Adventures in Wonderland playing at the Lyric Opera theatre from June 5th to June 22nd. I went this weekend and highly recommend. Their interpretation of the Cheshire Cat was my favorite part. If you see it, let me know what you thought of the performance! Remember to pay your taxes and have a great week!

Thanks for reading! I’m doing research for an article about the urban planning space generally and could use your help. If you work in urban planning or an urban planning adjacent field, or you live in a city and care about how it functions, please take a minute and fill out this 5 minute survey and pass it around your networks. Thanks in advance!

» Survey Link «

I’m a transit planner by day. If you want transit service in your area to be better, but don’t know how to make good transit service, check out the Transit Planning 101 section of my page!

and humility, if you’ll believe it 💖

I know it’s a Canadian example, but the lessons cross borders

Especially if you’re designing in a way that assumes everybody’s going to drive everywhere

If your initial reaction is “The Illinois Policy Institute is a conservative source. I’m not listening to them,” I can’t stop you. However, you stunt your personal growth by hanging out in echo chambers

Self identified progressive

This has not accelerated the 6+ month timeline required to hire in other departments

In recent years, this department has gotten more than twice as efficient per their own reports

This was his second budgeting cycle after campaigning on not raising property taxes

I think he’s a valuable voice in conversations about sound financial governance. I also think his squabbles with YIMBY dilute a clear and simple message; we need to build more housing. I think his criticism is based in a sincere interest in providing nuance to the housing discourse, but I don’t think nuance is the most pressing issue right now. It’s getting our current systems to overcome the inertia of how we’ve always done things, and (if we’re going to work within those systems) clear and simple carries much better than nuanced and jargon-y

I’m a proud member of Strong Towns Chicago.